Export Factoring

Get up to 90% of your invoice value upfront and protect yourself from buyer defaults with non-recourse financing.

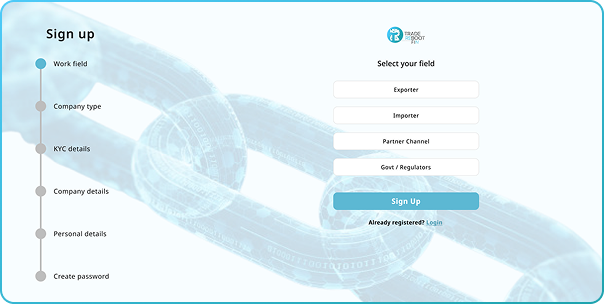

Your capital shouldn't be locked while your goods are in transit. With NiryatSetu’s trade finance suite, you can unlock funding right from your dashboard—digitally and securely.

Financing costs as low as 0.2% per week, depending on translation frequency and volume.

Calculate rates for import/export financing with our user-friendly rate calculator. Get quick disbursement of funds and transparent information on financing costs. Focus on growing your business while we handle your financing needs.

Access capital through our alliance with 20+ NBFCs, private banks, and fintech lenders.

Quick Credit Line Approval in just 48 Hours

NiryatSetu connects trade finance directly with your shipment and documentation process. No toggling between banks, spreadsheets, and freight providers—everything works in sync.

Trade finance refers to financial instruments that bridge the gap between product shipment and payment receipt in global trade. It helps exporters receive early payments, manage cash flow, and reduce risk.

We offer export factoring, LC discounting and confirmation, bill discounting, supply chain finance, and invoice-based financing—all accessible through a single platform.

Unlike traditional loans, NiryatSetu's trade finance is transaction-linked, faster to process, and doesn't always require collateral. It's designed for the exporter's business cycle.

Yes, NiryatSetu specializes in serving Indian MSMEs by offering collateral-free financing backed by data and export documentation.