Verified Trade Data

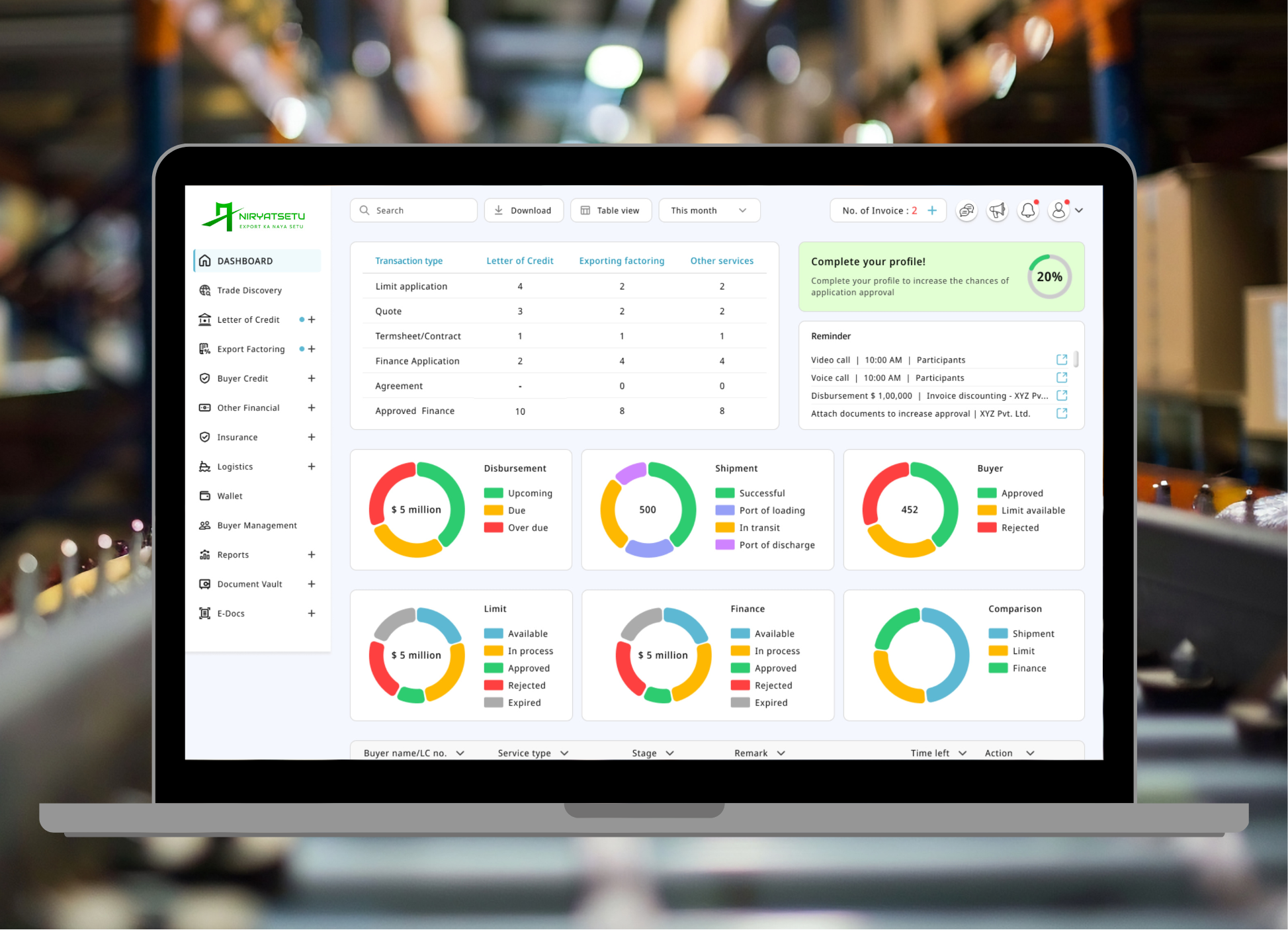

Access real-time data on shipments, invoices, customs filings, and buyer transactions.

Access real-time data on shipments, invoices, customs filings, and buyer transactions.

Engage only with exporters who pass KYC, behavior profiling, and transaction vetting.

Ensure GST-compliant invoicing and track documents like eBRCs, shipping bills, and BLs.

Lend strategically across sectors, geographies, and buyer segments to reduce risk.

Banks and financiers will have access to all documents uploaded by applicant.They can generate KYC report, Credit Analysis Report, Credit Rating on our platform which will be done by partnered third parties. They can also use their own system for analysis. These analysis will help to take decision on Finance Limit, Fund amount, interest rate, percentage of trade to be funded, other parameters and T&C.We also perform our own instantaneous Analysis report: AIA, to determine credit-worthiness of applicants, banks & Financier will also have access to that report.

Financial Institutions can deploy NiryatSetu's FinTech stack under their own brand. From onboarding to fund disbursement, every module can be tailored to your workflows.

NBFCs, banks, digital lenders, credit funds, trade finance institutions, and fintechs can all integrate to offer structured trade finance services.

We use e-KYC, credit ratings, transaction history, and our AIA engine to assess borrower credibility.

Yes. You can set thresholds for exposure, invoice value, margins, and define custom funding criteria.

We digitize export LC workflows—linking documentation, counterparty checks, and e-BRCs for smooth disbursements.